A leading surf forecasting company is determining whether to enter a new market, snowboarding or wakeboarding. A detailed framework and analysis was used to assess the best market to enter; more details can be found below the Executive Summary.

Executive Summary

The goals and challenges for each of the market’s user bases are similar. Each user wants to maximize their time participating in their respective activity in the best conditions possible. To meet these needs, accurate conditions and forecasts need to be available to compare the timing and location of the future session. There are many barriers to adoption, including existing competitors, lack of user flexibility when choosing session dates, and activity seasonality.

The table below summarizes the findings of the potential new market.

| Criteria | Snowboard Market | Wakeboard Market | |

|---|---|---|---|

| Competitive Landscape | Ability to Differentiate | Medium | Medium |

| Competitive Intensity | High | Low | |

| Barriers to Entry | Medium | High | |

| Market Opportunity | Market Size | High | Medium |

| Growth Rate | Flat | Negative | |

| Attractiveness | Strategy & Technical Fit | Medium | Low |

| Existing Capabilities | Medium | Low |

The market size, demand, and the ability to leverage existing weather forecasting models make snowboarding a better opportunity for investment.

However, before moving forward with creating a product for the snowboard market, other potential investment opportunities should be analyzed and compared, including expanding into under-penetrated surf markets.

Introduction

When analyzing the existing snowboard and wakeboard markets, the assumption was made to include snow skiing and water skiing1 respectively. For each of these markets, the user base and recreational areas overlap and the potential user demand would be similar.

This market analysis focused on the current and forecasting capabilities for the US snow and inland watersport conditions. It excluded international markets, and news, gear, travel, and video which are considered media and would require a much broader analysis.

1 Wake surfing is not included. Although this is a high growth market, there is not enough data currently available. The assumption would be these user’s needs would be similar to the water skiing and wakeboarding market.

Overview

The following framework was used to analyze user demand, market size, and crossover competencies to recommend the best market to enter:

- User Definition

- Goals and Challenges

- Market and Competitor Analysis

- Size

- Growth Rate

- Competitors

- Internal Capabilities Assessment

- Existing core competencies to respond to new market demand

- Existing users which can be converted to a new product

Defining the User

Before embarking on a detailed market analysis, a base understanding of the potential users must be defined. The following table summarizes the users’ key goals and challenges for each of the respective markets.

| Snowsports Market | Watersports Market | |

|---|---|---|

| Goals | Ability to know where and when the best snow and weather conditions will exist at a specific ski/snowboard area | Ability to know where and when the best wind and water conditions will exist at a specific water-sport area |

| Challenges |

|

|

If additional user insights are needed, detailed personas for different demographics could be drafted from user interviews, however, this was considered out of scope for this initial assessment.

After understanding the users’ desires, a high level solution to how these challenges would be solved and common objections to those proposals were drafted.

| Snowsports Market | Watersports Market | |

|---|---|---|

| How to overcome user's challenge? | Provide access to compare accurate current and forecast snow and weather conditions at specific ski areas from anywhere | Provide access to compare accurate current and forecast wind and weather conditions at specific wakeboard areas from anywhere |

| Common Objections to Product Adoption | Free:

Premium:

| Free:

Premium:

|

Market Analysis

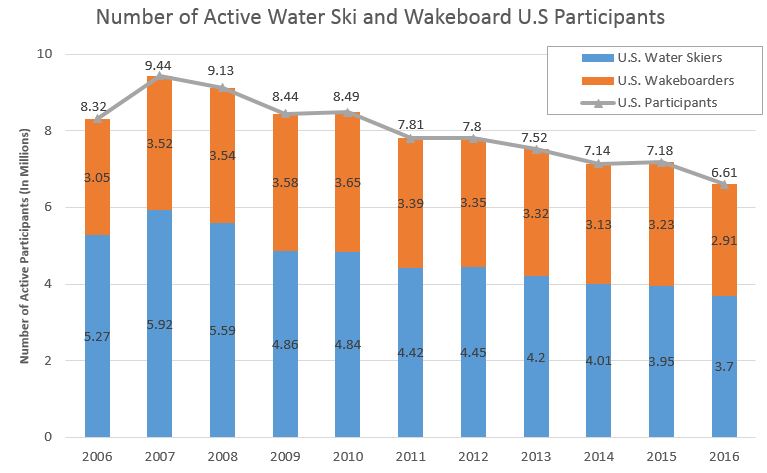

Size and growth rate for each market were compared to help determine how many potential users would be available for a new product. A participant was defined as someone who participates in the sport at least once annually.

As seen in the table below, the watersports market is much smaller and has seen year over year declines. However, the average number of session days per participant is 40% higher for the watersports market, which makes the total number of sessions yearly about equal to that of the snowsport market.

Additional research could be done to segment the markets into high (> 10 sessions/ year), average (4 -10 sessions/year), and low (1-3 sessions/year) frequency participants and to understand the geographic location of participants.

| Snowsports Market | Watersports Market | |

|---|---|---|

| Market Size (2016) | 9.2 Million | 6.6 Million |

| 5 Year Growth Rate | Flat to ~ +1% | - 3 % / Year |

| Average Number of Session Days / Participant | ~ 6 | ~ 8.5 |

| Total Number of Sessions Yearly | 55.2 Million | 56.1 Million |

| Seasonality | Winter ~ 5 Months (November – March) | Summer ~ 6 Months (April – September) |

Sources: Snowsports Market – NSAA.ORG; Watersports Market (Wakboarding)(Skiing)

Competitor Analysis

A quick google search produced the following key competitors for the respective snow and watersports markets. Although both markets are mature, the snowsports market contains substantially more established products that focus on the on mountain and forecasted snow conditions.

Out of the top three snowsports products, OpenSnow ranked much higher in usability and quality of content. Two out of the three competitors have Premium membership perks for a fee and all three offer a free mobile app.

It was difficult to find any products that focused on the inland watersports market for waterskiing and wakeboarding conditions. Although the WindFinder UX was pleasant to visualize the current and future wind conditions, it is difficult quickly compare the local conditions across potential recreational areas. Both the free and paid mobile app versions are highly rated with a substantial number of reviews, but the product looks to be more highly adopted by the wind/kitesurfing and ocean sailing communities. This would make the product more of an existing competitor to the surf forecasting company than a future competitor in the inland watersports market.

Snowsports Market Analysis

| Snow-Forecast.com | OpenSnow.com | OnTheSnow.com | |

|---|---|---|---|

| Weather and Wind | Yes | Yes | Yes |

| Recent Snowfall Report | Yes | Yes | Yes |

| Snowfall Forecasts | 6-Day | 5-day (free); 10 day with premium | 7-Day |

| Historical Snowfall Repots | Only with premium up to 20 years | Yes for two months, with premium up to 7 years | Yes, up to 8 years |

| Webcams | Yes | Yes, time-lapse only with premium | Yes |

| Territory Coverage | Global | Global | Global |

| User Reports | Yes | Daily snow reports with detailed long term analysis written by local forecasters (free) | User posted snow reports and pictures |

| Other Notes | • Editor written blog covering gear, weather, lifestyle and travel | • Editor written news and snow pack analysis • Favorites can only be added with premium | • User Ratings for resorts • Editor written travel and product reviews, weather blogs, news |

| Premium Membership | Yes, $31 / year | Yes, $19 / year | No |

| Overall Look and Feel | • 2 / 5 Star • Difficult navigation to quickly find the resort and conditions • Can remove banner adds with premium | • 4 / 5 Star • Best look and feel with easy to navigate summaries of current conditions, forecasted snowfall, and ski resort lift open status • Ability to remove adds with premium | • 2.5 / 5 Star • Clunky advertisements throughout pages |

| Mobile App | Yes (Free; 2.5 Stars – 7 reviews) | Yes (Free; 4.5 Stars – 67 Reviews) | Yes (Free; 2 Stars – 174 Reviews) |

| Website | https://www.snow-forecast.com | https://opensnow.com/ | https://www.onthesnow.com |

Competition derived from Top Google Searches: “Snow Forecast”; “Snow Report”

Watersports Market Analysis

| WindFinder.com | |

|---|---|

| Weather and Wind | Yes |

| Detailed Wind Report | Yes, with current direction and speed at weather stations |

| Wind Forecasts | 10 Day |

| Historical Weather Data | Yes, cost based on amount of data requested |

| Webcams | Yes |

| Territory Coverage | Global |

| User Reports | No |

| Other Notes | • Ability to save Favorites but only by “cookie” tracking; cannot setup a User ID • Does not have ability to quickly compare conditions across areas |

| Premium Membership | No |

| Overall Look and Feel | • 3.5 / 5 Stars • Very interactive and easy to navigate UX • Bottom Banner Ads |

| Mobile App | Yes (Free version – 5 Stars, 1,093 Reviews); (Pro Version - $3.99; 5 Stars, 1,069 Reviews) |

| Website | https://www.windfinder.com |

Competition derived from Top Google Searches: “Wakeboard Forecast”; “Waterski Forecast”; “Wind Forecast”

Notes: Competitive analysis focused on the desktop experience and does not include “weather” websites (Accuweather, Weather.com, Wunderground). Although these are highly used sites and would be competitive for the infrequent participant, the assumption is made that a new product would be competing against the specific players in the on mountain / water submarket as detailed above. Additional user research could be conducted to validate this assumption.

Overall look and feel is defined as

- Color palette

- Images

- Layout

- Font choices

- Overall Styling

- Menus, buttons, and galleries dynamic response

- Advertisement location and maturity

- Page and image load speed

Internal Capabilities Assessment

When creating a new product for a mature market it is important to leverage existing core competencies and market to existing customers.

The surf forecasting company’s current products provide:

- Real-time surf reports

- Accurate surf forecasting

- Streaming surf webcams

- Surf news, blog articles, and videos

The existing wind and weather forecasting models can be utilized for both markets, however they would need to be optimized to produce local on mountain / water accuracy. Partnerships for both markets would need to be established for webcam feed and current condition integration, however, the number of recreational snowsport areas are significantly smaller than the number of in land watersport areas.

Although formal research was not done, it is assumed that there is a small (<25%) percentage of participants that would be existing customers and also snowboard. Of these participants, most are probably more concentrated in the SoCal market where the access to surfing and snowsports are a relatively short distance from each other. These existing customers are recommended as the pilot participants for the first product MVP.